direct vs indirect cash flow gaap

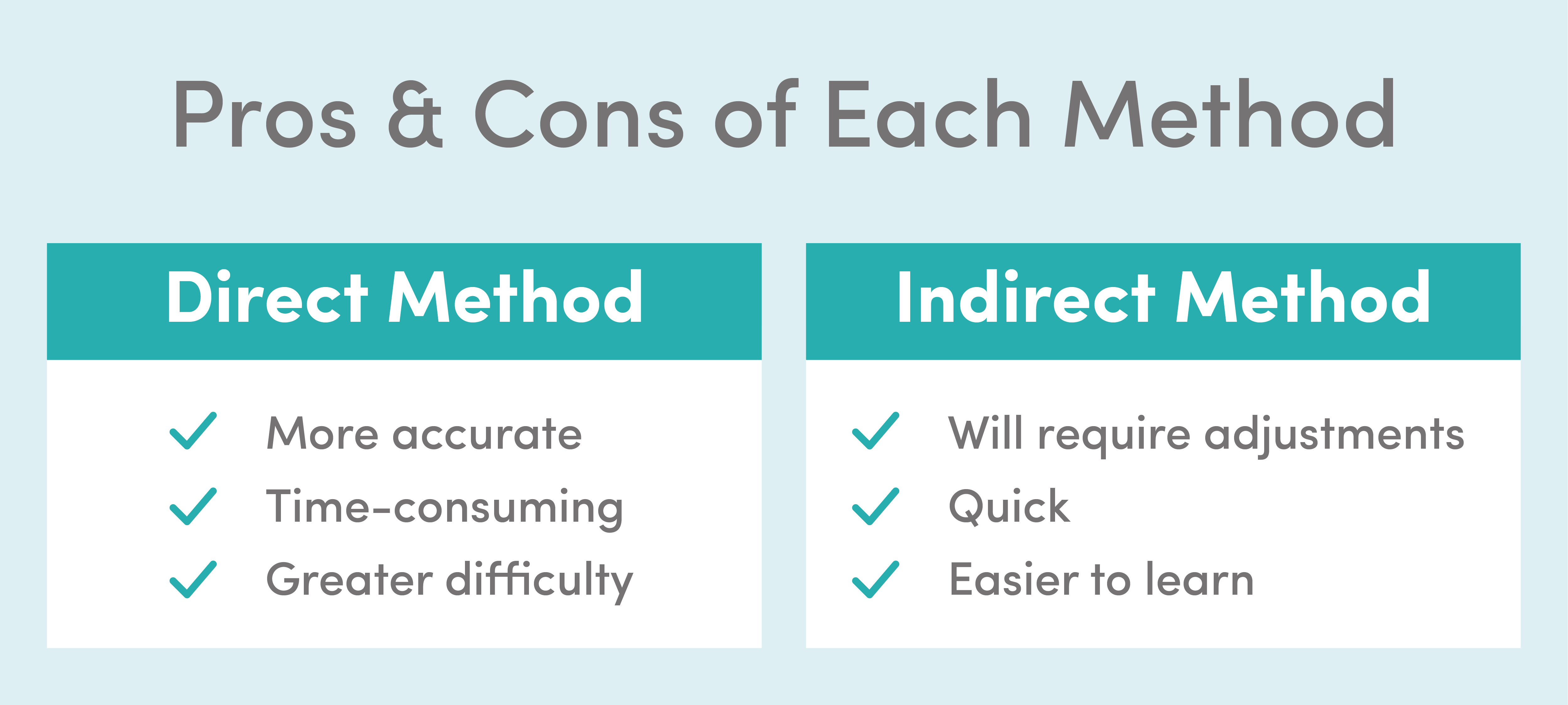

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. Either the direct or indirect method may be used.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

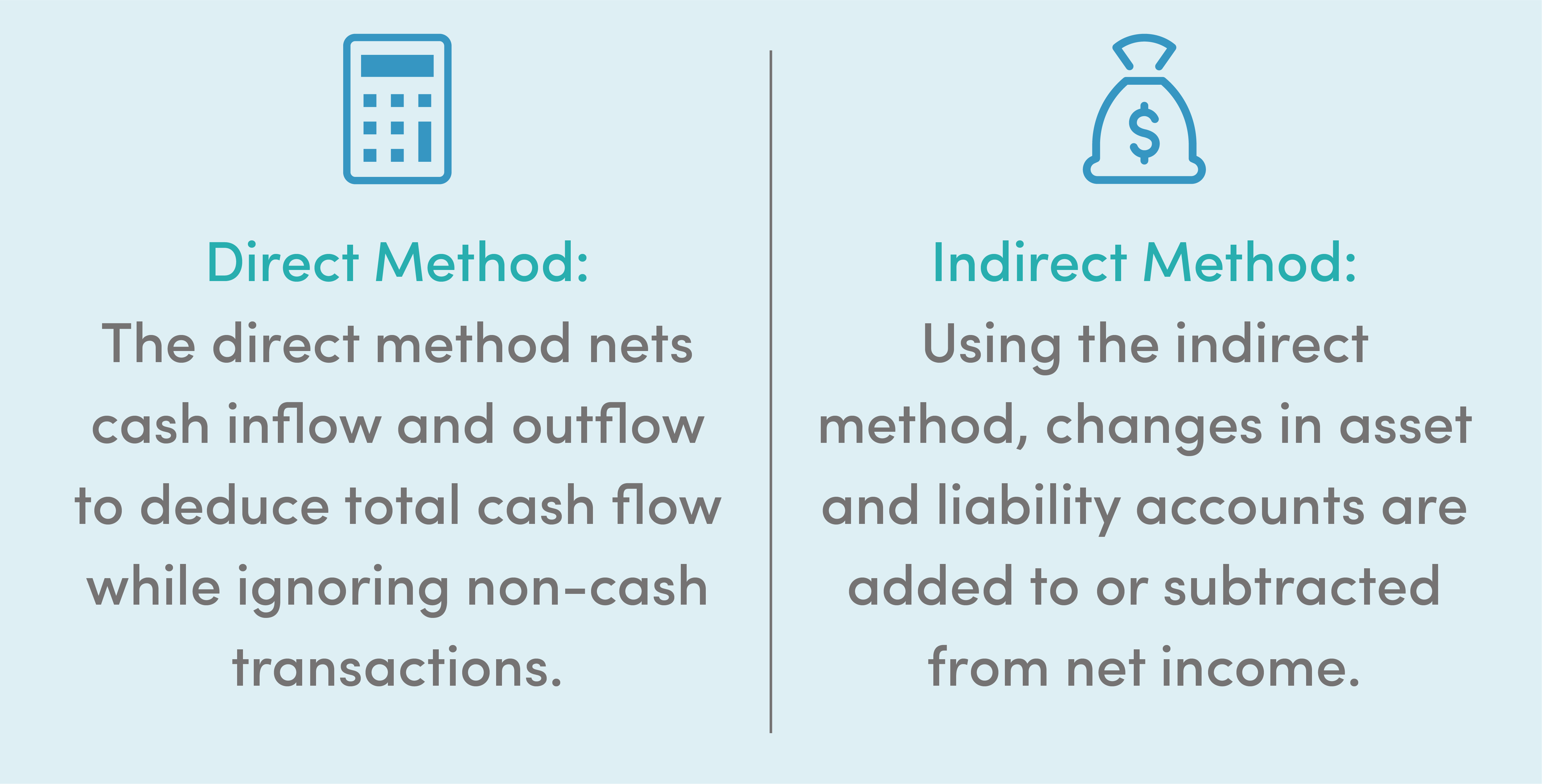

With the indirect method cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions.

. Although the presentation of operating cash flows differs between the two methods both methods result in the same. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No.

The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part. Non-cash items show up in the changes to a companys assets and liabilities on the balance sheet from one period to the next. 106 Both encourage the use of the direct method.

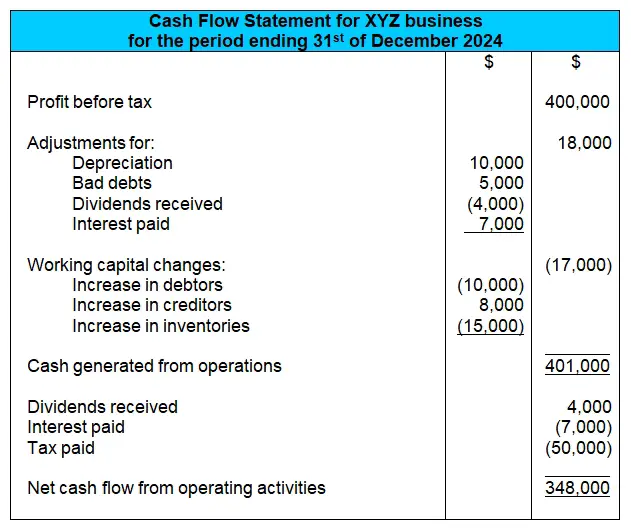

Below is an example of the cash flow from operations segment of a cash flow statement prepared under IFRS using the indirect method. Either the direct or indirect method may be used for reporting cash flow from operating activities. Net income must be reconciled to net cash flows from operating activities.

The indirect method works from net income so the bottom of. The direct method details where cash comes from and where it goes. US GAAP shows bank overdrafts as financing activities.

Clinch G Sidhu B Sin S. Adjusting net income to operating cash flows is easier and less costly than reporting gross operating cash receipts and payments which is the case in the direct method. GAAP requires a reconciliation of net cash flow from.

Interest paid must be classified as an operating activity. Non-cash expenses like depreciation and amortization are ignored in the direct method while they are taken into consideration in the indirect method. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors.

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. Interest and dividends Interest received or paid is classified as operating activities. This is why both IFRS and US GAAP recommend the direct method.

Direct method vs indirect method The direct method provides information about specific sources and uses of cash but the indirect method shows only the net result. In the direct method reconciliation is used to separate various cash flows from others while in the indirect method the conversion of net income is done in cash flow. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis.

Either the direct or indirect Net income must be reconciled to net cash flows from operating activities if the indirect method is used. In contrast the indirect method starts with net income for-profit entities or the change in net assets NFP entities adds back non-cash expenses removes gains and losses and adjusts for the changes in current asset and current liability accounts. 108 In addition unlike IFRSs US.

GAAP also calls the indirect method the reconciliation method. The usefulness of direct and indirect cash flow. Direct Method or Income Statement Method.

Do core and non-core cash flows from operations persist differentially in predicting future cash flows. US GAAP Requirements Interest received must be classified as an operating activity. However of the two the direct method is generally encouraged.

Comparing the Direct and Indirect Cash Flow Methods The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Review of Quantitative Finance and Accounting 311 29-53. As discussed in ASC 230-10-45-28 cash flows related to operating activities may be presented in one of two ways the direct method or the indirect methodThe presentation of investing and financing activities are identical under the direct and indirect methods.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. Indirect Cash Flow Method. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Direct Vs Indirect The Best Cash Flow Method

The Indirect Cash Flow Statement Method

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Ebitda Vs Cash Flow From Operations Vs Free Cash Flow

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Statement Of Cash Flows Indirect Accounting Finance Saving Cpa Exam

27 Understanding Cash Flow Statements

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

27 Understanding Cash Flow Statements

Fa 51 Module 12 Video 3 Financial Statement Analysis Vertical Analysis Problem 12 2a Youtu Financial Statement Analysis Financial Statement Analysis

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Co Managerial Accounting Cost Accounting Accounting Education

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn